ModelOps Market Size, Share And Industry Report, 2033

ModelOps Market Size & Trends

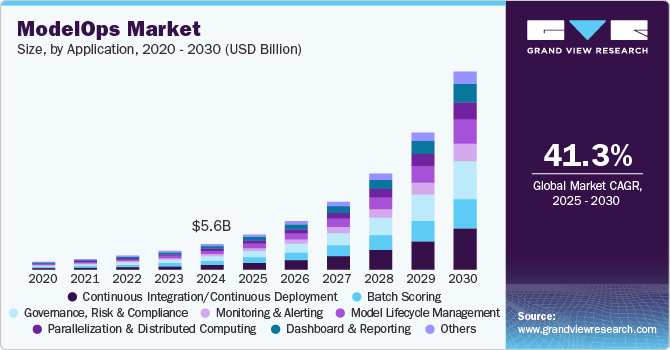

The global modelOps market size was estimated at USD 5.64 billion in 2024 and is expected to grow at a CAGR of 41.3% from 2025 to 2030. Rapid AI and ML adoption across industries, needs for scalability large-scale AI deployment, cost efficiency and automation, and AI model performance monitoring are primarily drivers of the ModelOps market. ModelOps helps businesses mitigate operational risks by providing tools to detect and rectify model drift or failures before they impact critical business processes, ensuring consistent decision-making and reducing potential disruptions.

Strict regulations, in various industries such as, BFSI, and healthcare require transparent, explainable, and compliant AI models. ModelOps platforms provide governance frameworks that help businesses meet regulatory requirements, avoiding costly compliance breaches and ensuring auditability. For instance, in December 2024, ModelOp, a foremost provider of AI governance software for enterprises announced a significant surge in platform usage throughout the year. New customer acquisitions drove this growth, the adoption of generative AI, and an increasing demand for its AI portfolio intelligence and governance solutions. For the second year in a row, the company achieved substantial and sustained expansion, particularly in the healthcare, financial services, and consumer packaged goods (CPG) sectors.

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/modelops-market-report

Offering Insights

The platforms segment led the market in 2024, accounting for over 67.0% share of the global revenue. As organizations increasingly adopt advanced AI techniques, the complexity of models escalates. This complexity necessitates robust ModelOps platforms to streamline development, deployment, and monitoring processes. Furthermore, the shift toward agile methodologies in software development drives the need for continuous integration and continuous deployment (CI/CD) capabilities. ModelOps platforms facilitate rapid iteration and deployment of AI models, enhancing responsiveness to changing business requirements.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2024. Organizations are increasingly adopting cloud-based ModelOps solutions due to their ability to scale resources up or down based on demand. This flexibility allows businesses to manage fluctuating workloads efficiently. Moreover, cloud deployment reduces the total cost of ownership compared to on-premises solutions.

Model Insights

ML models segment accounted for the largest market revenue share in 2024 in the ModelOps industry. Continuous improvements in machine learning algorithms enhance the performance and accuracy of predictive models, making them more viable for diverse applications.

Application Insights

The Continuous Integration/Continuous Deployment (CI/CD) segment accounted for the largest market revenue share in 2024. Organizations are increasingly adopting CI/CD practices to enhance their operational efficiency and accelerate the deployment of machine learning models.

Vertical Insights

The BFSI segment accounted for the largest market revenue share in 2024 in the ModelOps industry. The BFSI sector faces stringent regulatory requirements that necessitate robust governance and compliance frameworks. ModelOps solutions help organizations ensure adherence to these regulations while managing risk effectively. The need to streamline processes and improve operational efficiency drives the adoption of ModelOps.

Regional Insights

The North America dominated with a revenue share of over 35.0% in 2024. The U.S. and Canada have stringent regulations, particularly in various sectors such as, BFSI, and healthcare. ModelOps frameworks are essential to help businesses meet compliance requirements for AI models, ensuring transparency and accountability.

Key ModelOps Companies:

The following are the leading companies in the modelOps market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Cloud Software Group, Inc.

- Cloudera, Inc.

- DataRobot, Inc.

- Domino Data Lab, Inc.

- Google Cloud

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Microsoft

- SAS Institute Inc.

Global ModelOps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global ModelOps market report based on the offering, deployment, model, application, vertical, and region.

Offering Outlook (Revenue, USD Million, 2017 - 2030)

Platforms

Services

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

Cloud

On-premises

Model Outlook (Revenue, USD Million, 2017 - 2030)

ML Models

Graph-based Models

Rule & Heuristic Models

Linguistic Models

Agent-based Models

Others

Application Outlook (Revenue, USD Million, 2017 - 2030)

Continuous Integration/ Continuous Deployment

Batch Scoring

Governance, Risk and Compliance

Parallelization & Distributed Computing

Monitoring & Alerting

Dashboard & Reporting

Model Lifecycle Management

Others

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

BFSI

Retail & E-commerce

Healthcare & Life sciences

IT & Telecommunications

Energy & Utilities

Manufacturing

Transportation & Logistics

Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

UK

Germany

France

Asia Pacific

China

India

Japan

Australia

South Korea

Latin America

Brazil

MEA

UAE

South Africa

KSA

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/modelops-market-report

Comments

Post a Comment