North America Food Service Equipment Market To Reach USD 11412 Million By 2030

North America Food Service Equipment Market Growth & Trends

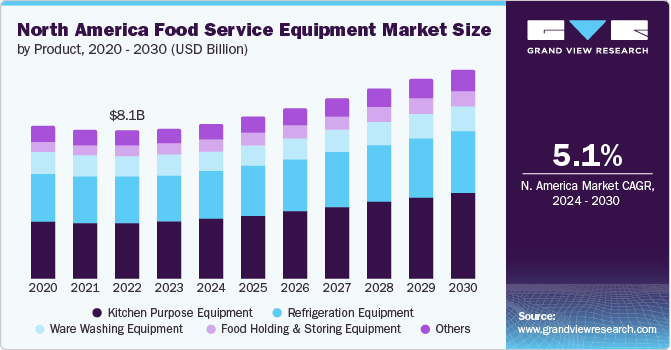

The North America food service equipment market size is anticipated to reach USD 11,412.1 million by 2030, registering a CAGR of 5.1% from 2024 to 2030, according to a new report by Grand View Research, Inc. The growth of the food service industry and surge in experiential dining across North America, characterized by innovative food presentations and flavors, is significantly driving the market growth for food service equipment.

In addition, the growth of full-service restaurants in North America is significantly boosting the market for food service equipment. As these establishments aim to provide top-notch dining experiences, there is a rising demand for high-quality, efficient kitchen equipment. From advanced ovens to innovative refrigeration solutions, restaurants are investing in state-of-the-art tools to enhance food preparation and storage. This trend toward high-quality food service delivery in the culinary industry is propelling the demand and innovation within the food service equipment sector, leading to market expansion.

Furthermore, the high growth of cloud kitchens is significantly boosting the demand for food service equipment. This surge can be attributed to several factors. First, the rising consumer preference for online food delivery services, fueled by the convenience they offer, has led to an increase in cloud kitchen operations.

Cloud kitchens, focusing solely on food preparation for delivery with no dine-in facilities, rely heavily on efficient, high-quality kitchen equipment to manage large volumes of orders. In addition, developing and introducing advanced equipment for the cloud kitchen setup optimizes the food preparation processes, reduces waste, and ensures consistent food quality.

Compliance with regulations is a significant challenge for the market due to the complex and ever-evolving nature of local, national, and international standards. Manufacturers must navigate numerous health, safety, and environmental regulations that vary by region and often require specialized knowledge and adaptations. This complexity increases production costs as companies need to invest in research, development, and testing to ensure their equipment meets all applicable standards. Major regulatory standards include the Food Safety Modernization Act (FSMA) in the U.S. and OSHA, among others.

Market players in North America are adopting several strategies, such as acquisitions, mergers, joint ventures, new service launches, and regional expansion, to enhance market penetration and cater to changing local demands from various end-use applications, including full-service restaurants and quick-service restaurants.

For instance, in December 2023, Haier Smart Home, a part of the Haier Group, announced its agreement with Carrier to acquire Carrier's Commercial Refrigeration Business. Haier Smart Home acquired 100% of the equity interest in Carrier, which owns Carrier Commercial Refrigeration. The total consideration for the transaction is around USD 640.0 million. Carrier Commercial Refrigeration is a company that manufactures commercial refrigeration equipment globally. It has more than 4,000 employees, of which 2,000 are service technicians. This acquisition will aid the company in expanding its presence in the cold storage and food retail sectors.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/north-america-food-service-equipment-market-report

North America Food Service Equipment Market Report Highlights

- The kitchen purpose equipment segment held the largest global revenue share in 2023. Restaurant equipment refers to the tools and appliances used in a commercial kitchen to prepare, cook, and serve food. It includes everything from kitchen appliances and utensils (such as ovens, refrigerators, and food storage containers).

- The food holding and storing equipment segment is expected to show lucrative growth over the forecast period. Products comprising this segment include dry storage cabinets and heated holding cabinets, each serving a unique purpose in maintaining food at optimal temperatures, whether hot or cold.

- The full-service restaurant segment held the largest share of the global revenue in 2023. Full-service restaurants need food service equipment to ensure smooth operation, maintain food safety standards, provide excellent customer service, and manage their time and space efficiently. As such, they are a key clientele for companies in the food service equipment market, driving demand for innovative, reliable, and cost-effective solutions.

- Quick service restaurant segment is expected to show lucrative growth over the forecast period. In QSRs, food service equipment plays a crucial role in maintaining the speed and quality of service. This equipment is designed to be durable, easy to clean, and produce consistent results quickly. Key equipment in a QSR includes deep fryers, grills, commercial ovens, beverage dispensers, and refrigeration units.

- The offline distribution channel type dominated the market in 2023, as manufacturers are relying on a network of authorized dealers to distribute their equipment. These dealers are usually well-versed in the product line and can offer additional installation, maintenance, and after-sales support.

- The online distribution channel type is expected to witness high growth in coming years, as manufacturers are increasingly opting for new distribution strategies, including online/e-commerce sales, to enhance their consumer reach. The digital marketplace is known for its competitive pricing strategies. Sellers can adjust prices more fluidly in response to market demands, promotions, and stock levels.

- The U.S. dominated the North America regional market. The food service equipment market in the U.S. is undergoing robust growth as lifestyles become busier; there is a growing preference for Quick Service Restaurants (QSRs) and takeaways, fueling the need for efficient, high-quality food service equipment.

- In May 2024, Haier Smart Home, a part of Haier Group, announced the establishment of its new manufacturing facility in Egypt, which spans 200,000 square meters. The facility will be utilized to manufacture refrigerators, freezers, and products. This move is aimed at expanding the company’s presence in the Middle East and Africa.

North America Food Service Equipment Market Segmentation

Grand View Research has segmented the North America food service equipment market based on service type, end-use, type, and country:

North America Food Service Equipment Product Outlook (Revenue, USD Million, 2018 - 2030)

- Kitchen Purpose Equipment

- Refrigeration Equipment

- Ware Washing Equipment

- Food Holding & Storing Equipment

- Others

North America Food Service Equipment End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Full-Service Restaurants (FSR)

- Quick Service Restaurants (QSR)

- Institutional

- Others

North America Food Service Equipment Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Online

- Offline

North America Food Service Equipment Country Outlook (Revenue, USD Million, 2018 - 2030)

- U.S.

- Canada

- Mexico

List of Key Players in the North America Food Service Equipment Market

- AB Electrolux

- Ali Group Worldwide

- Dover Corporation

- Blue Star Limited

- Duke Manufacturing

- FUJIMAK CORPORATION

- Haier Group

- HOSHIZAKI CORPORATION

- Illinois Tool Works Inc.

- MARUZEN CO., LTD.

- SMEG S.p.A.

- The Middleby Corporation

- The Vollrath Company, LLC

- AK Service & Food Equipment

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/north-america-food-service-equipment-market-report

Comments

Post a Comment