Flea, Tick And Heartworm Products Market To Reach USD 10.90 Billion By 2030

Flea, Tick And Heartworm Products Market Growth & Trends

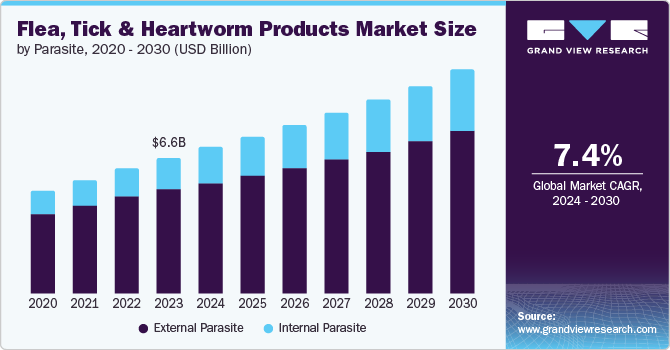

The global flea, tick and heartworm products market size is

expected to reach USD 10.90 billion by 2030, registering a CAGR of 7.4% from

2024 to 2030, according to a new report by Grand View Research, Inc. The market

is experiencing an upsurge in developing and launching innovative products.

These products can effectively manage parasitic complications in cats &

dogs and prove to be a useful parallel option for treatment for pet owners and

veterinarians. One such prominent example is flea & tick control collars.

These products are just like normal pet collars but contain a specific drug capable

of repelling the infestation of fleas, ticks and mosquitoes for some time.

Apart from Seresto by Elanco, other

emerging and established players are actively investing in the development of

similar collars but utilize novel approaches to enhance infestation control.

These launches can also be considered attempts by other companies to capture

the market amidst the lawsuit against Seresto Collar. For example, in January

2024, Neogen Corporation launched a collar named Provecta. This collar uses a

combination of drugs called deltamethrin and methoprene to inhibit flea and

tick growth in dogs and cats. This collar claims to provide six months of

protection from fleas, ticks, and mosquitoes.

Furthermore, approvals for injectable products

capable of providing long-term animal protection are further intensifying the

competitive rivalry. For example, in May 2023, Merck Animal Health received

approval for the Bravecto Quantum sale in Australia. This injectable

parasiticide can provide over one year of protection against fleas & ticks.

Such instances act as catalysts in driving the market by promoting innovative

product development that can effectively address the gaps in the prevention

& treatment of FTH complications in animals.

Another crucial driver of the demand for these

flea, tick and heartworm products is the rising cases of flea and tick

infestation in animals worldwide. For example, according to a May 2024 study

published in the Veterinary Medicine & Science Journal, the prevalence of

fleas and ticks in dogs from the African country of Ethiopia was estimated to

be 69.7% and 36.7%, respectively.

Moreover, across the world, in India, the

infestation rate of ticks was estimated to be 57.1% in dogs, according to the

January 2024 study published in the Acarological Studies Journal. Furthermore,

a March 2023 study published in Psyche Journal of Entomology estimated that the

prevalence of fleas and ticks in cats from Iran was around 89% and 63%,

respectively. This high infestation rate of parasites like fleas and ticks points

towards the growing need for effective products to bring this infestation under

control, hence boosting market growth.

Request a free sample copy

or view report summary: https://www.grandviewresearch.com/industry-analysis/flea-tick-heartworm-products-market

Flea, Tick And Heartworm

Products Market Report Highlights

- Based

on product, the treatment products segment accounted for the largest

revenue share of 76.00% in 2023. This segment is further divided into

products like spot-on, oral pills/chewables, sprays, liquid solutions,

shampoos, etc. This spot-on product took the highest share owing to its

ease of access, greater absorption, and effective treatment.

- Based

on type, the prescription segment dominated the with a market share of

over 60.00% in 2023. Most flea and tick medications doctors prescribe are

taken orally, typically as a tasty, chewable tablet or applied topically

for ectoparasites like fleas & ticks.

- Based

on animal, the canine segment dominated with a share of over 48.00% in

2023 because dogs are the primary species affected by FTH complications,

and there are several flea, tick, and heartworm preventative and treatment

options available for dogs. The market has grown due to an increasing

prevalence of parasite infection in the canine population.

- Based

on mode of delivery, the topical segment dominated the market in 2023 due

to its advantages over oral flea, tick, and heartworm medications. One of

the primary advantages of topical flea treatments is that many are not

systemically absorbed, which means they do not penetrate the skin barrier

or enter a pet's bloodstream. This may be advantageous for animals with a

history of adverse drug reactions or who have not previously responded

well to oral flea treatments.

- Based

on parasite, the external parasite segment dominated the market in 2023.

This is attributable to the high prevalence of external parasites like

fleas and ticks among dogs and cats.

- Based

on care, the preventive care segment held the dominant revenue share in

2023 and is expected to witness the fastest CAGR over the forecast period.

This can be attributed to the fact that veterinarians, as well as animal

welfare organizations throughout the world, focus on taking preventive

measures for flea, tick and heartworm complications.

- Based

on distribution channel, the online segment is estimated to grow the most

over the forecast period. This growth is driven by factors such as

increasing penetration of online pharmacies in under-developed and

developing economies, increasing variety of OTC products, and, most

importantly, the convenience of procuring flea, tick and heartworm

products.

- In

2023, North America accounted for the largest market share of 39.71%. The

number of Americans who own pets is increasing, which is driving up demand

for flea, tick and heartworm products. The region's need for FTH products

is also anticipated to grow as the incidence of illnesses caused by fleas,

ticks, and heartworms in pets rises.

- The

Asia Pacific (APAC) market is anticipated to grow at a CAGR of over 8.9%

over the forecast period owing to this high transmission rate of

vector-borne infections in dogs & cats in the region, and the need for

appropriate veterinary medications.

Flea, Tick And Heartworm

Products Market Segmentation

Grand View Research has segmented the global

flea, tick and heartworm products market based on product, type, animal, mode

of delivery, parasite, care, distribution channel, and region:

Flea, Tick And Heartworm

Product Outlook (Revenue, USD Million, 2018 - 2030)

- Diagnostic

Products

- Test

Kits

- Consumables

- Treatment

Products

- Spot

on

- Oral

pills/Chewable

- Spray

- Liquid

Solution

- Shampoo

- Others

Flea, Tick And Heartworm

Products Type Outlook (Revenue, USD Million, 2018 - 2030)

- Prescription

- OTC

Flea, Tick And Heartworm

Products Animal Outlook (Revenue, USD Million, 2018 - 2030)

- Canine

- Feline

- Others

Flea, Tick And Heartworm

Products Mode of Delivery Outlook (Revenue, USD Million, 2018 - 2030)

- Topical

- Oral

- Injectable

Flea, Tick And Heartworm

Products Parasite Outlook (Revenue, USD Million, 2018 - 2030)

- External

Parasite

- Internal

Parasite

Flea, Tick And Heartworm

Products Care Outlook (Revenue, USD Million, 2018 - 2030)

- Preventive

Care

- Therapeutic

Care

Flea, Tick And Heartworm

Products Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital/Clinic

Pharmacy

- Retail

Pharmacy

- Online

Pharmacy

Flea, Tick And Heartworm

Product Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North

America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia

Pacific

- Japan

- India

- China

- South

Korea

- Australia

- Thailand

- Latin

America

- Brazil

- Argentina

- Middle

East and Africa (MEA)

- South

Africa

- Saudi

Arabia

- UAE

- Kuwait

List of Key Players in the

Flea, Tick And Heartworm Products Market

- Zoetis

- Boehringer

Ingelheim

- Merck

& Co. Inc

- Virbac

- Elanco

- Ceva

- Promika,

LLC

- Sergeant's

Pet Care Products, Inc.

- Adams

- BioNote

Inc.

- Secure

Diagnostics Ltd.

- iNtRON

Biotechnology

- Biopanda

Reagents Ltd.

Comments

Post a Comment