Gene Therapy Market Size To Reach USD 29.51 Billion By 2030 | CAGR: 19.5%

Gene Therapy Market Growth & Trends

The global gene therapy market is expected to reach USD 29.51 billion by 2030, registering a CAGR of 19.5% from 2024 to 2030, according to a new report by Grand View Research, Inc. The development of the market is owing to an increase in the number of gene therapy-based discoveries, increasing investment in this sector, and rising approval of gene therapy products. According to the WHO, 10 to 20 new cell and gene therapies are expected to be approved each year by 2025.

Continuous developments in recombinant DNA technology are anticipated to enhance the efficiency of gene therapy in the coming years. Hence, ongoing progresses in recombinant DNA technology are anticipated to expand the number of ongoing clinical trials for gene therapy. Primarily, these advancements are taking place in the context of various gene-editing tools and expression systems to augment the R&D for products. The advent of CRISPR/Cas9 nuclease, ZFN, and TALEN allows easy & precise genome editing. As a result, in recent times, the gene-editing space has witnessed a substantial number of research activities, which, in turn, is expected to influence the growth of the gene therapy market.

The growth of the gene therapy market is expected to be majorly benefitted from the increasing prevalence of cancer. The ongoing increase in cancer patients and related death per year emphasizes the essential for the development of robust treatment solutions. In 2020, there were around 18.1 million new cases of cancer worldwide. 9.3 million of these cases involved men, while 8.8 million involved women. Continuing developments in tumor genetic studies have delivered substantial information about cancer-related molecular signatures, which in turn, is expected to support ongoing clinical trials for cancer therapeutics.

With rising demand for robust disease treatment therapies, companies have focused their efforts to accelerate R&D for effective genetic therapies that target the cause of disease at a genomic level. . Furthermore, the U.S. FDA provides constant support for innovations in this sector via a number of policies with regard to product manufacturing. In January 2020, the agency released six final guidelines on the manufacturing and clinical development of safe and efficient products.

Furthermore, facility expansion for cell and gene therapies is one of the major factors driving the gene therapy market growth. Several in-house facilities and CDMOs for gene therapy manufacturing have begun investing to enhance their production capacity, which, in turn, is anticipated to create lucrative opportunities for market players. For instance, in April 2022, the FDA approved commercial licensure approval to Novartis for its Durham, N.C. site. This approval permits the 170,000 square-foot facility to make, test, and issue commercial Zolgensma, as well as manufacture therapy products for current & upcoming clinical trials.

Request a free sample copy or view the report summary: Gene Therapy Market Report

The COVID-19 outbreak has negatively impacted the market growth. This sector has experienced severe disruption due to COVID-19, which has historically presented significant challenges in the supply of materials, manufacturing, and logistics operations. For instance, companies had lengthy delivery times for specific components and later discovered that it was short on clinical trial supplies when a partner contract manufacturing company was compelled to shut down.

The robust pipeline is expected to boost the market growth over the forecast period. Researchers are working to make gene therapy available at clinics. Various universities and institutes exhibit a broad portfolio of products in the pipeline which is expected to boost revenue generation over the forecast period. Clinical trials for gene therapy increased significantly from 2017 to 2018, after the FDA approved first gene therapy. According to the American Society of Gene & Cell Therapy (ASGCT), around 1,986 products, including CAR T-cell therapies and other genetically modified cell therapies, are currently under development.

Gene Therapy Market Report Highlights

The AAV segment shows a significant revenue contribution of 22% in 2023. Several biopharma companies are offering their viral vector platform for the development of AAV-based gene therapy product.

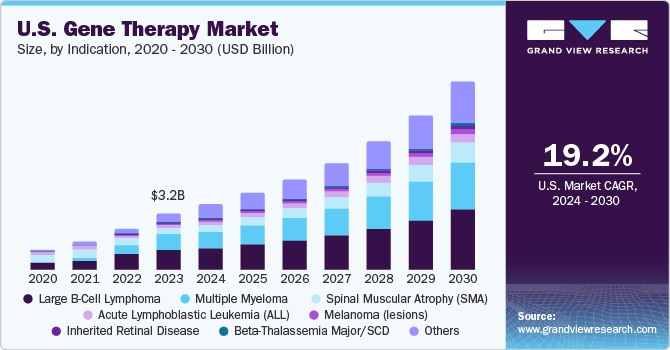

By indication, the spinal muscular atrophy (SMA) segment dominated the market in 2023 with a share of 46.8%. Although SMA is a rare disorder, it is one of the most common fatal inherited diseases of infancy.

The Beta-Thalassemia Major/SCD segment is anticipated to register the fastest CAGR of 38.3% over the forecast period. Gene therapy for SCD and β-thalassemia is based on transplantation of gene-modified hematopoietic stem cells.

North America dominated the market in 2023 with the largest revenue share of 65.2% in 2023. This region is expected to become the largest routine manufacturer of gene therapy in terms of the number of approvals and revenue generated during the forecast period.

Europe is estimated to be the fastest-growing regional segment from 2024 to 2030. This is attributed to its large population with unmet medical needs and increasing demand for novel technologies in the treatment of rare but increasingly prevalent diseases.

Regional Insights

North America dominated the market in 2023 with the largest revenue share of 65.2% in 2023. This region is expected to become the largest routine manufacturer of gene therapy in terms of the number of approvals and revenue generated during the forecast period. Increasing investments in R&D from large and small companies in the development of ideal therapy drugs are anticipated to further boost the market.

Furthermore, the increasing number of investments by the governments and the growing prevalence of targeted diseases are the factors fueling the market. According to the Spinal Muscular Atrophy Foundation, in 2020, around 10,000 to 25,000 children and adults in the U.S. were affected by spinal muscular atrophy, making it a fairly common disease among rare diseases.

Europe is estimated to be the fastest-growing regional segment from 2024 to 2030. This is attributed to its large population with unmet medical needs and increasing demand for novel technologies in the treatment of rare but increasingly prevalent diseases. Asia Pacific market for commercial application of genetic therapies is anticipated to witness significant growth in the forecast period, which can be attributed to the easy availability of resources, local presence of major companies, and increased investment, by the governments.

Gene Therapy Market Segmentation

Grand View Research has segmented the global gene therapy market report based on indication, vector type, route of administration, and region:

Gene Therapy Indication Outlook (Revenue, USD Million, 2018 - 2030)

Acute Lymphoblastic Leukemia (ALL)

Inherited Retinal Disease

Large B-cell Lymphoma

ADA-SCID

Melanoma (lesions)

Beta-Thalassemia Major/SCD

Head & Neck Squamous Cell Carcinoma

Peripheral arterial disease

Spinal Muscular Atrophy (SMA)

Others

Gene Therapy Vector Type Outlook (Revenue, USD Million, 2018 - 2030)

Lentivirus

AAV

RetroVirus & gamma RetroVirus

Modified Herpes Simplex Virus

Adenovirus

Non-viral Plasmid Vector

Others

Route of Administration (Revenue, USD Million; 2018-2030)

Intravenous

Others

Gene Therapy Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Asia Pacific

Japan

China

South Korea

Australia

Rest of the world

List Of Key Players in the Gene Therapy Market

REGENXBIO, Inc.

Oxford BioMedica plc

Dimension Therapeutics, Inc.

Bristol-Myers Squibb Company

SANOFI

Applied Genetic Technologies Corporation

F. Hoffmann-La Roche Ltd

bluebird Bio, Inc.

Novartis AG

Taxus Cardium Pharmaceuticals Group, Inc. (Gene Biotherapeutics)

UniQure N.V.

Shire Plc

Cellectis S.A.

Sangamo Therapeutics, Inc

Orchard Therapeutics

Gilead Lifesciences, Inc.

BENITEC BIOPHARMA

Sibiono GeneTech Co., Ltd

Shanghai Sunway Biotech Co., Ltd.

Gensight Biologics S.A.

Transgene

Calimmune, Inc.

Epeius Biotechnologies Corp.

Astellas Pharma Inc.

American Gene Technologies

BioMarin Pharmaceuticals, Inc.

Comments

Post a Comment