Automotive Aftermarket Industry To Reach $589.01 Billion By 2030

Automotive Aftermarket Industry Growth & Trends

Automotive Aftermarket Industry Growth & Trends

The global automotive aftermarket industry size is expected to reach USD 589.01 billion by 2030, according to a new report by Grand View Research, Inc. The market is anticipated to expand at a CAGR of 3.9% from 2024 to 2030. Digitalization of automotive repair & component sales complemented by advanced technology incorporations in the automobile aftermarket component manufacturing is expected to boost the market growth. The surging reception of semi-autonomous, electric vehicles, and hybrid & autonomous cars, in the years to come, is further expected to bolster the demand for new components.

Furthermore, the increasing vehicle penetration is driven by the overall improvement of lifestyle in developing countries, such as India and Brazil, and is expected to drive the growth of the automobile industry in the region. Similar surges in the automotive manufacturing sector across various regions along with the increasingly stringent emissions norms are expected to drive the growth of automotive aftermarket component sales over the forecast period. Third-party services and technology offer new and profitable revenue streams, to leverage all these opportunities.

In addition, the industry requires investment in product development, supply chain, organizational design, and pricing model to create a great surge in demand. The rise of digital channels or social media influence is also fueling the sale of the automotive aftermarket. These online channels provide customers with all the information regarding the price of the past, and the prior user experience, making the purchasing process smoother. To support the initiatives for leveraging market foothold, the manufacturers in developing countries are adopting various strategies, including mergers, acquisitions, and partnerships.

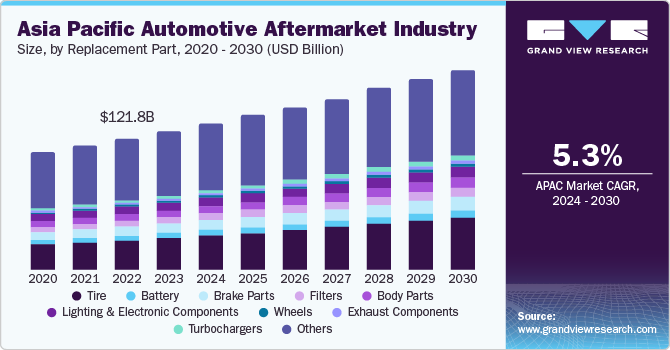

The Asia-Pacific regional market is expected to be the fastest growing market for aftermarket over the forecast period, owing to its developing living standards and high vehicle production. It is also anticipated to be the fastest-growing market in automobile production. With the growing penetration and acceptance of gas and hybrid electric cars, specialized repair centers dedicated to the repair of particular vehicles are expected to increase. The global aftermarket is expected to witness tremendous growth due to an upsurge in the number of vehicle collisions along with the inclination of owners toward the repair of their automobiles.

Digitization of component delivery sales & services, along with the advent of an online portal distributing aftermarket components in synchrony with the global auto-part supplier groups, are expected to draw huge investments from key companies. For instance, the leading market component suppliers, such as US Auto Parts Network, Inc. and CarParts.com, would drive the global market demand in the years to come. Owing to the above-mentioned trade gateways, online aftermarket business arcade parades have high potential in developing countries. In addition, growing online sales of automotive components are estimated to deliver significant demand for the market.

Companies are now shifting to digital platforms owing to the smoother experience for customers. In January 2020, Continental AG announced its online portal that will contain a portfolio of all of its services and information about its products for the market. The value chain of the market comprises two primary segments: automotive replacement part suppliers and service enablers. These prime industry segments are exchanging value through the automotive sectors at several intermittent stages. Access to elaborative component assortment coupled with the simplicity of transactions, delivered through the digitalization of the global automotive component sales, is destined to resolve the obtainability issues, thereby driving the automobile aftermarket industry.

Request a free sample copy or view report summary: Automotive Aftermarket Industry Report

Automotive Aftermarket Industry Report Highlights

The automotive aftermarket is estimated to grow significantly over the forecast period, owing to an increase in the number of lightweight vehicles coupled with the increasing age of the light vehicle fleet

In terms of market size, the tire segment is expected to account for the largest share of 22.5% in 2023.

In terms of market size, the retail segment dominated the market with a share of 55.5% in 2023 and is expected to remain dominant throughout the forecast years.

In terms of market size, the original equipment segment dominated the market with a share of 70.5% in 2023. The OE segment is anticipated to dominate the aftermarket arena in terms of size by 2030.

In terms of market size, the genuine parts segment dominated the market with a share of 51.6% in 2023. The genuine parts segment is anticipated to dominate the aftermarket arena, in terms of size, by 2030.

The Asia Pacific automotive aftermarket dominated the market with a share of 28.8% in 2023. The regional market is expected to have significant growth from 2024 to 2030.

Regional Insights

The North America automotive aftermarket is anticipated to grow at a CAGR of 2.7% from 2024 to 2030. In addition, there is a growing trend of vehicle customization in the region, where owners modify their vehicles to reflect their tastes and preferences. This includes aftermarket upgrades, such as performance parts, aesthetic enhancements, audio systems, lighting modifications, and more.

U.S. Automotive Aftermarket Industry Trends

The automotive aftermarket in the U.S. held a dominant share of 76.4% in 2023. The U.S. has seen a significant expansion of e-commerce channels. Online retailers and marketplaces have gained popularity due to the convenience of purchasing parts and accessories online. E-commerce offers a wide range of products, competitive pricing, and simplified shopping experiences.

Europe Automotive Aftermarket Industry Trends

The Europe automotive aftermarket is expected to reach USD 110.29 billion by 2030. Europe is at the forefront of automotive technology, and this has influenced the aftermarket sector. The integration of advanced technologies in vehicles, such as ADAS, electric and hybrid systems, and connectivity features, has created opportunities for aftermarket solutions and retrofits to meet the changing needs of European vehicle owners.

Automotive Aftermarket Industry Segmentation

Grand View Research has segmented the automotive aftermarket industry report based on replacement parts, distribution channel, service channel, certification, and region:

Automotive Aftermarket Replacement Part Outlook (Revenue, USD Billion, 2017 - 2030)

Tire

Battery

Brake parts

Filters

Body parts

Lighting & Electronic components

Wheels

Exhaust components

Turbochargers

Others

Automotive Aftermarket Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

Retailers

OEMs

Repair Shops

Wholesalers & Distributors

Automotive Aftermarket Service Channel Outlook (Revenue, USD Billion, 2017 - 2030)

DIY (Do It Yourself)

DIFM (Do It for Me)

OE (Delegating to OEM’s)

Automotive Aftermarket Certification Outlook (Revenue, USD Billion, 2017 - 2030)

Genuine Parts

Certified Parts

Uncertified Parts

Automotive Aftermarket Regional Outlook (Revenue, USD Billion, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

U.K.

France

Asia Pacific

China

India

Japan

South America

Brazil

Middle East & Africa

List of Key Players of Automotive Aftermarket Industry

3M Company

Continental AG

Cooper Tire & Rubber Company

Delphi Automotive PLC

Denso Corporation

Federal-Mogul Corporation

HELLA KGaA Hueck & Co.

Robert Bosch GmbH

Valeo Group

ZF Friedrichshafen AG

Browse Full Report: Automotive Aftermarket Industry Report

Comments

Post a Comment