U.S. Virtual Visits Market Size To Reach USD 105.5Bn By 2030

U.S. Virtual Visits Market Growth & Trends

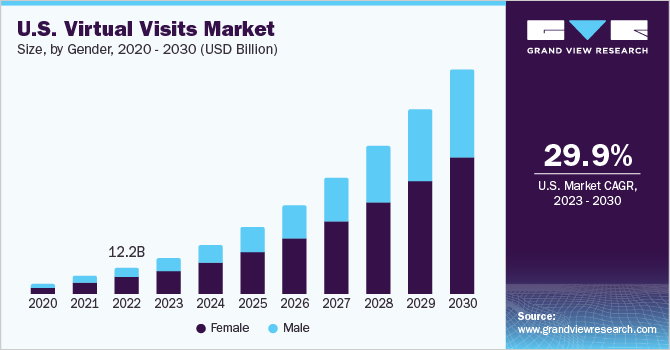

The U.S.

virtual visits market size is expected to reach USD

105.5 billion by 2030, expanding at a CAGR of 29.9% from 2023 to 2030,

according to a new report by Grand View Research, Inc. Increasing demand for

telehealth and teleconsultation and introduction of new and advanced technologies

has positively impacted the growth of the market in the U.S. Increasing

penetration of smartphones and assisted technologies has also been a key factor

for the fast growth of the market.

In

the service segment, cold and flu management had the largest market share in

2022. The major factor behind the growth of the market is the growing demand

for teleconsultations for patients for treatment of common conditions like cold

and flu to reduce the chances of contracting additional illnesses due to

hospital visits. The availability of specialists through telehealth and

teleconsultations, even in remote areas has brought about a revolution in the

virtual visits market, acting as a key factor for the growth of the market.

Based

on age, the 18 to 34 years segment had the largest market share in

2022. The growth is a result of increasing smartphone penetration and

increased internet usage by the consumers in this age group. The increase in

the number of young adults suffering from mental health issues has also risen

in the past few years and more so during COVID-19, resulting in a large market

share.

Based

on gender, women dominated the market with a revenue share of 64.5% in

2022. The increasing demand for telemedicine and telehealth has increased

due to COVID-19 to reduce the chances of contracting additional infections,

especially in pregnant females. The virtual visits made it easier for all to

get access to specialists and better healthcare facilities within the comfort

of their homes, proving to be a major factor in the growth of this segment and

the market overall.

Based

on the type of commercial plans, self-funded/ASO group plans had the largest

revenue share. Growth in this segment has been a result of ASO groups proposing

and encouraging virtual visits in their coverage plans to avoid regular visits

to hospitals in avoidable conditions. During the pandemic, only non-emergency

visits throughout the country were encouraged by healthcare providers to avoid

the risk of infection. In wake of the pandemic, employers are increasingly

preferring self-coverage plans and providing cost-effective healthcare services

for their employees to diminish the exploding healthcare costs, which is

further enhancing the growth of the market.

The

COVID-19 pandemic created a massive growth spurt for the virtual visits market

in the U.S. With the people needing healthcare solutions during the peak of the

pandemic, teleconsultations were providing the necessary care that was needed.

The huge jump in the uptake of virtual consultations was a result of government

initiatives as well as fear of contracting the disease by physically visiting

the hospitals. It came as a necessary relief for the healthcare providers as

well, where they were less burdened due to the use of teleconsultations in case

of non-emergency cases. The overall productivity of the healthcare system had

also improved, proving the virtual visit market has been a great success and

would be a way to consult in the future as well.

Request a free sample copy: https://www.grandviewresearch.com/industry-analysis/us-virtual-visits-market

U.S. Virtual Visits Market Report Highlights

·

The U.S. market is expected to reach USD 105.5 billion by 2030,

due to rising demand for telehealth services and virtual visits and also due to

advancements in the field of delivering virtual care through apps and connected

devices

·

The cold and flu management service segment had the biggest

revenue share as of 2022. Growing adoption rates of telehealth solutions to get

consultations regarding common conditions have risen during the pandemic, this

has been a result of awareness and encouragement by all private and government

agencies to curb the spread of the disease

·

The age group 18-34 held the largest revenue share in 2022, this

has been due to the increasing use of smartphones and internet-connected

devices, increasing burden of mental health issues among the consumers in this

age, and ease of access to healthcare through virtual visits, all contributing

to the growth of the segment

·

In the gender segment, women dominated the market with a record

revenue share of 64.5% in 2022. The increasing adoption of virtual visits

during the pandemic had created a safe environment for pregnant women to

receive the best healthcare without physically going to hospitals and quality

post-natal care was also made available for women, resulting in the overall

growth of the market

U.S. Virtual Visits Market Segmentation

Grand

View Research has segmented the U.S. virtual visits market report based on

service type, age group, gender, and commercial plan type:

Service Type Outlook (Revenue & Volume, USD Million &

Million Units, 2018 - 2030)

·

Cold & Flu management

·

Allergies

·

Urgent Care

·

Preventive Care

·

Chronic Care Management

·

Behavioral Health

Age Group Outlook (Revenue & Volume, USD Million & Million

Units, 2018 - 2030)

·

Age 18-34

·

Age 35-49

·

Age 50-64

·

Age 65 and above

Gender (Revenue & Volume, USD Million & Million Units,

2018 - 2030)

·

Male

·

Female

Commercial Plan Type (Revenue & Volume, USD Million &

Million Units, 2018 - 2030)

·

Small Group

·

Self-funded/ASO Group Plans

·

Medicaid

·

Medicare

List of Key Players in the U.S. Virtual Visits Market

·

American Well

·

MDLIVE

·

Doctor On Demand by Included Health, Inc.

·

eVisit

·

Teladoc Health, Inc.

·

MeMD

·

HealthTap, Inc.

·

Vidyo, Inc.

·

PlushCare

·

Zipnosis

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/us-virtual-visits-market

Comments

Post a Comment