Viral Vector And Plasmid DNA Manufacturing Market To Reach $19.5 Billion By 2030

Viral Vector And Plasmid DNA Manufacturing Market Growth & Trends

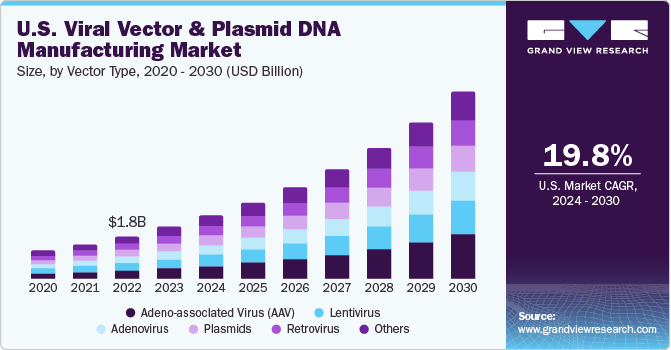

The global viral vector and plasmid DNA manufacturing market size is anticipated to reach USD 19.5 billion by 2030 and it is projected to grow at a CAGR of 20.2% from 2024 - 2030, according to a new report by Grand View Research, Inc. With the increasing demand for plasmid DNA and viral vectors for gene therapy, industry leaders have launched new technologies to boost plasmid DNA manufacturing. For instance, in April 2018, GE Healthcare Life Sciences introduced KUBio BSL 2, a prefabricated, modular bioprocessing facility for the production of oncolytic viruses, cell and gene treatments, and immunizations based on viral vectors.

With the increase in investments in cell and gene therapy research space, there is unprecedented demand for viral vectors in the market. Owing to this, various organizations are providing funds to accelerate developments in the manufacturing processes for these vectors. For instance, in September 2019, Next Generation Manufacturing Canada provided USD 1.89 million to a consortium led by iVexSol Canada. This fund was provided for the development of an advanced manufacturing process for lentiviral vectors. 2iVexSol Canada is a vector manufacturing company that has collaborated with several companies to develop an advanced LVV manufacturing platform.

Moreover, the major companies operating in this market, such as Thermo Fisher Scientific, QIAGEN NV, Agilent Technologies, Takara Bio, Inc., and Oxford Biomedica, are focusing on developing new gene delivery platforms. These companies are making huge investments to scale up the production of biological gene delivery systems to meet the increasing market demand. For instance, in May 2020, Takara Bio, Inc. completed the Center for Gene and Cell Therapy Processing II (CGCPII) construction in Shiga, Japan. This center is an addition to its GMP viral vector production facility. Similarly, in May 2020, Thermo Fisher Scientific also invested USD 180 million to scale up its viral vector manufacturing capacity twofold. Such increasing initiatives are anticipated to propel market growth in the forecast period.

Furthermore, large-scale production of viral vectors is facing challenges in upstream and downstream processing. In upstream processes, the method used for viral vector production is one of the major hurdles for manufacturers. Reproduction of adherent cell cultures at a large scale is a key concern that needs to be addressed. Thus, researchers are trying to grow these cells using large bioreactors. In addition, there is a need for a better understanding of the purity of these vectors in downstream processing.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/viral-vector-manufacturing-market

Viral Vector And Plasmid DNA Manufacturing Market Report Highlights

- Based on the vector type, the adeno-associated virus (AAV) segment dominated the market with a 20.0% revenue share in 2023 due to high demand, and their usage in clinical trials is growing

- Based on the workflow, the downstream processing segment led the market in 2023 with the largest revenue share in workflow segment due to advancements in downstream processing technologies and the adoption of single-use systems

- Based on the application, the vaccinology segment dominated the application segment in 2023 with the largest revenue share, and cell therapy is expected to grow at fastest CAGR during the forecast period

- Based on the end-use, the research institutes segment dominated the market with the largest revenue share in 2023. On the other hand, the pharmaceutical and biopharmaceutical companies are expected to grow at a fastest CAGR over the forecast period

- In terms of disease, the cancer segment dominated the market with the largest revenue share in 2023 and it is anticipated to grow at fastest CAGR during the forecast period

- North America dominated the market owing to factors such as the significant burden of cancer, and infectious diseases, high purchasing power parity, government support for quality healthcare, and availability of reimbursement

Viral Vector and Plasmid DNA Manufacturing Market Segmentation

Grand View Research has segmented the global viral vector and plasmid DNA manufacturing market based on the vector type, workflow, application, end-use, disease, and region:

Viral Vector and Plasmid DNA Manufacturing Vector Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Adenovirus

- Retrovirus

- Adeno-Associated Virus (AAV)

- Lentivirus

- Plasmids

- Others

Viral Vector and Plasmid DNA Manufacturing Workflow Outlook (Revenue, USD Billion, 2018 - 2030)

- Upstream Manufacturing

- Vector Amplification & Expansion

- Vector Recovery/Harvesting

- Downstream Manufacturing

- Purification

- Fill Finish

Viral Vector and Plasmid DNA Manufacturing Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Antisense & RNAi Therapy

- Gene Therapy

- Cell Therapy

- Vaccinology

- Research Applications

Viral Vector and Plasmid DNA Manufacturing End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Pharmaceutical and Biopharmaceutical Companies

- Research Institutes

Viral Vector and Plasmid DNA Manufacturing Disease Outlook (Revenue, USD Billion, 2018 - 2030)

- Cancer

- Genetic Disorders

- Infectious Diseases

- Others

Viral Vector and Plasmid DNA Manufacturing Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Kuwait

List of Key Players in the Viral Vector and Plasmid DNA Manufacturing Market

- Merck KGaA

- Lonza

- FUJIFILM Diosynth Biotechnologies

- Thermo Fisher Scientific

- Cobra Biologics

- Catalent Inc.

- Wuxi Biologics

- Takara Bio Inc.

- Waisman Biomanufacturing

- Genezen laboratories

- Batavia Biosciences

- Miltenyi Biotec GmbH

- SIRION Biotech GmbH

- Virovek Incorporation

- BioNTech IMFS GmbH

- Audentes Therapeutics

- BioMarin Pharmaceutical

- RegenxBio, Inc.

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/viral-vector-manufacturing-market

Comments

Post a Comment