Veterinary Hospitals Market Size, Share, Trends And Forecast 2030

The global veterinary hospitals market size is expected to reach USD 125.07 billion by 2030, registering a CAGR of 5.7% over the forecast period, according to a new report by Grand View Research, Inc. Boom in pet population is driving the market growth. As per the American Veterinary Medical Association, over the next 10 years, the number of dogs and cats in the U.S. is anticipated to increase substantially. The dog populace is likely to rise from 85 million in 2020 to over 100 million by 2030. While cat populace is likely to surge even more intensely, from 65 million to more than 82 million. This upsurge in the pet population will drive the market. Despite the difficulties and new ways of working formed by the COVID-19 pandemic, for numerous hospitals, client numbers are growing.

Free Sample Report: https://www.grandviewresearch.com/industry-analysis/veterinary-hospitals-market-report

In addition, veterinary practice activity in the U.S. has

fluctuated, but in general, the demand remains high. According to the

Veterinary Industry Tracker, revenue per practice was up 13.3% year-over-year

(November 2020 to November 2021). Client visits were up 5.1% during the same

period. In numerous households across the globe, pets are seen as a core member

of the family. There is a growing trend of pet humanization, resulting in an

increased average spend on pet healthcare. Thus, pet humanization is set to

drive the sales of veterinary services. This trend will be led by the growing

population of small animals along with economic growth in developing markets.

Improvements in technology have advanced veterinary care.

Technology is becoming more affordable and more practices

around the world can adopt MRI and CT scanners. Digital dental X-rays and

innovative oral surgery instruments are allowing veterinarians to advance in

oral care in companion animals. Constant developments further address health

issues in pets not just within hospitals, but on an all-around basis for better

care and prevention. Access to veterinary healthcare is relatively

underprivileged in most developing countries and some developed nations. For

instance, according to a survey conducted in 2020 by the Federation of

Veterinarians of Europe, rural and remote areas of Ireland have a shortage of

veterinarians. Similarly, England is also experiencing a shortage of

veterinarians in rural areas. This may restrict the market growth to some

extent.

Veterinary Hospitals

Market Report Highlights

·

In terms of revenue, the medicine segment

dominated the market in 2021. The high demand for animal products, such as

chicken and milk, is encouraging farmers to adopt vaccinations for their

animals to gain higher profitability

·

The surgery type segment is estimated to

register lucrative CAGR over the forecast period due to the growing pet

insurance & healthcare expenditure and rising cases of chronic diseases in

pets

·

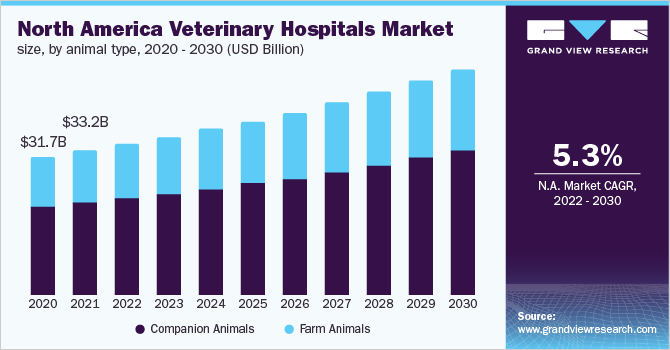

Companion animals dominated the animal type

segment in 2021 due to the growing trend of pet humanization

·

The private sector segment led the market in

2021 due to the growing disposable income and willingness to pay premium prices

for veterinary services among owners

·

Asia Pacific is expected to witness a lucrative

CAGR over the forecast period owing to the increased vigilance about animal

health and rapid urbanization

·

In February 2020, DCC (Dogs Cats &

Companions) Animal Hospital announced the launch of a series of multi-specialty

animal hospitals across India. These hospitals will be advanced and equipped

with innovative infrastructure and medical expertise

·

Industry players are involved in strategic

initiatives, such as business expansion, M&As, and geographic expansion to

gain higher market shares

·

For instance, in June 2021, CVS Group announced

the establishment of a new state-of-the-art specialist veterinary hospital in

Bristol, which will open in 2022, with modern technology and treatments in all

disciplines

Key Companies &

Market Share Insights

The hospitals are constantly involved in strategic

initiatives, such as regional expansion, mergers, acquisitions, and new service

launches, to gain a higher market share. For instance, in February 2021, the

CVS group announced the purchase of the Market Hall Vets, a first opinion

practice functioning three locations across Carmarthenshire in southwest Wales.

In May 2020, Greencross Vets introduced WebVet a 24/7 online consultation

service. Thus, enhanced its service offering to Australia’s network of 1000 veterinary

professionals. Some of the prominent players in the global veterinary hospitals

market include: CVS Group PLC, Greencross Vets, Ethos Veterinary Health, Pets

At Home Group PLC, Mars, Animal Hospital Inc., All Pets Animal Hospital, Cahaba

Valley Animal Clinic, Blaine Central Veterinary Clinic, Belltowne Veterinary

Center

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/veterinary-hospitals-market-report

Comments

Post a Comment