U.S. Telehealth Market Size, Share, Trends And Forecast 2028

The U.S. telehealth market size is expected to reach USD 307.7 billion by 2028, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 44.4% from 2022 to 2028. The increasing adoption of digital health services, favorable consumer base, and substantial investment are the major factors contributing to the market growth in the U.S. Besides, growing demand for remote patient monitoring, coupled with the advancement of digital communication technology to support and improve healthcare services, is anticipated to accelerate the market growth over the forecast years. The shortage of physicians and clinicians in the U.S. is also expected to propel the telehealth industry growth. For instance, according to the Association of American Medical Colleges report published in June 2021, the estimated shortage of physicians in the U.S. could be between 37,800 and 124,000 by 2034, in both specialty and primary care.

Increasing remote patient visits using digital healthcare platforms due to social distancing practice during the COVID-19 pandemic in the U.S. are expected to boost the market growth over the forecast years. For instance, according to the Centers for Disease Control and Prevention (CDC), there is a 154% increase in telehealth visits in the U.S. during March 2020 as compared to the previous year i.e. March 2019. Remote digital healthcare services offered multiple benefits during the pandemic by reducing disease exposure for patients and staff. Growing access to the Internet by the U.S. population and increasing use of devices such as computers, tablets, and smartphones are also anticipated to provide potential industry growth opportunities.

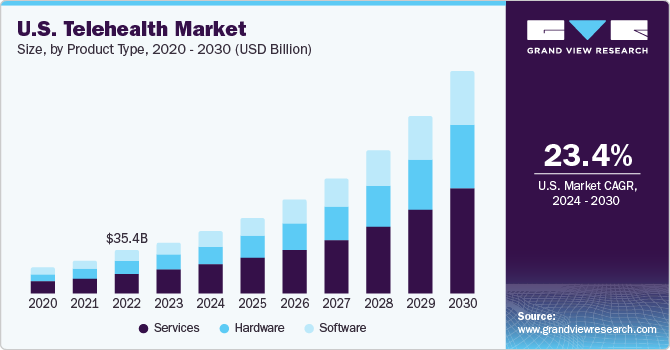

The services segment held the largest revenue share in 2021. The growing demand for remote patient monitoring services that offer real-time interactions of the patients with the physicians is anticipated to drive the services segment in the U.S. Remote patient monitoring services have become smarter and affordable with improved clinical outcomes. These types of services attract the service providers to invest more in the telehealth market. Healthcare organizations in the U.S. are constantly changing their infrastructure to catch up to this revolution in healthcare. To integrate remote healthcare services, the healthcare organizations in the U.S. are rapidly upgrading themselves with the six most essential components such as IT infrastructures, hardware, software, Internet of things (IoT), scalable design, data, and patient security. For instance, in June 2021, Persistent Systems collaborated and invested in IBM to improve its digital transformation, core IT modernization facilities, and hybrid cloud platform for the customers

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/us-telehealth-market

U.S. Telehealth Market Report Highlights

- The market growth can be attributed to the favorable consumer base, well-equipped digital health infrastructure, and increasing awareness regarding telehealth

- On the basis of product type, the services segment dominated the market in 2021 due to the growing adoption of remote patient monitoring services

- Based on delivery mode, the web-based segment led the market in 2021 owing to the increasing use of the web-based platform for telehealth and the availability of a large number of web-based telehealth solutions

- By end use, the providers segment dominated the market in 2021 owing to the increasing number of providers in the U.S. and they offer telehealth services not only in the U.S. but also all over the world

Key Companies & Market Share Insights

The key market players are rapidly focusing on the expansion of their digital healthcare services through collaborations, acquisitions, and investments. For instance, in June 2021, GE Healthcare collaborated with the American College of Cardiology (ACC) to build a road map for digital technology using Artificial Intelligence (AI) technology for improved health outcomes in cardiology including valvular heart disease, coronary artery disease, and heart failure. Similarly, in January 2018, Philips made partnerships with American Well in telehealth to provide better consumer health and professional healthcare. Further, in May 2020, American Well raised USD 194 million to meet the skyrocketing demand for remote healthcare services. Some prominent players in the U.S. telehealth market include: Koninklijke Philips N.V., Siemens Healthineers, Cerner Corporation, GE Healthcare, Medtronic PLC, Teladoc Health Inc., American Well, Doctor on Demand, U.SMed, MDLive

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/us-telehealth-market

Comments

Post a Comment