Agrochemicals Market Size, Share, Trends And Forecast 2030

The global agrochemicals market size is expected to reach USD 289.5 billion by 2030, according to a new report by Grand View Research, Inc. It is projected to expand at a CAGR of 3.2% during the forecast period. This increase can be attributed to the need for fertilizers and awareness of insecticides and fertilizers among consumers.

Rapid industrialization and population growth have reduced the amount of arable land available, which has led to an increase in the use of agrochemicals such as fertilizers and plant growth regulators which has further fueled the market expansion. The agrochemicals sector has also benefited from the rising demand for crops needed in the role of animal feed and fiber in the textile industry.

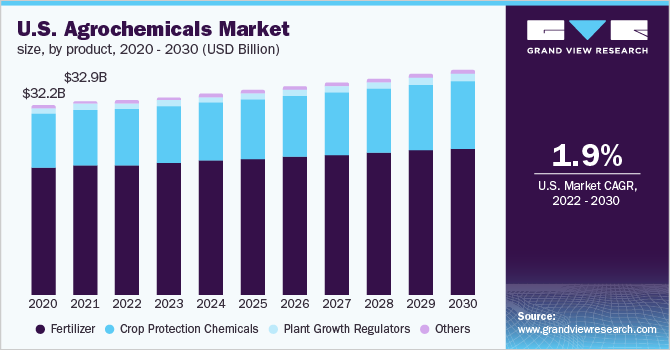

In 2021, fertilizers dominated the market for agrochemicals. Due to their low cost and simple availability, phosphate and nitrogen fertilizers were most frequently used. The demand for biofertilizers has increased due to the recent trend of organic farming, which completely forgoes chemical-based fertilizers.

The market for agrochemicals was dominated by the fertilizer category. The pressure on agricultural land is rising due to the rising crop and food demand around the world, so farmers are using more amount of fertilizers to boost crop production and yield. The industry was worth USD 150.3 billion in 2021 and is anticipated to reach USD 188.08 billion by 2030, expanding at a CAGR of 2.8% during the forecast years.

Plant growth regulators such as auxins and cytokinins are expected to expand at the highest rate in the forecast period. The growing popularity of organic farming is expected to be a major driver of this segment, increasing its penetration in the market during the analysis period.

The growing concern regarding environmental safety among consumers and industrialists is influencing manufacturers to launch eco-friendly agrochemical products that have no or minimal impact on the environment. The companies operating in the agrochemicals market are consistently engaged in R&D and developing innovative and eco-friendly products. For instance, Clariant is offering bio-based green agricultural adjuvant “Synergen OS”. This product is made up of methylated seed oil.

Asia Pacific accounted for maximum ammonium phosphate consumption in 2019. The region, led by China, remained the largest manufacturer and consumer of fertilizers and other agrochemicals in the same year. The economies of most of the countries in this region including India, China, and Japan are dependent on agriculture, which has increased the demand for fertilizers, thereby increasing the demand for ammonium phosphates.

Europe was the largest consumer of nitric acid and accounted for around half of the total consumption. This region, led by countries such as Sweden and Spain, has witnessed growth in its agriculture sector, driving the demand for nitric acid and ammonium nitrate. This has played a key role in the growth of the market for ammonium nitrate and nitric acid.

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/medical-specimen-tracking-system-market-report

Agrochemicals Market Report Highlights

- The fertilizers product segment dominated the market, as they are very useful for the proper growth and nutrition of the crops. The segment was valued at USD 150,356.8 million in 2021 and is estimated to reach USD 188,082.9 million by 2030, registering a CAGR of 3.2% during the forecast years

- Asia Pacific dominated the market due to factors such as the widespread presence of agro-based industries, including vegetable oil manufacturing, textiles, sugar, and animal husbandry, in the region

- The fruits and vegetable application segment is expected to expand with the highest CAGR through 2030. This growth can be attributed to the high demand for fruits and vegetables from health enthusiasts

- Agrium, Bayer CropScience, and Yara International were some of the key manufacturers in 2021, with distribution facilities spread across all regions

Key Companies & Market Share Insights

There are various tier I, tier II, and local players, which makes the worldwide market quite competitive. The market is flooded with items from manufacturers, such as fertilizers with increased potency and pesticides like herbicides, rodenticides, fumigants, insecticides, fungicides, and plant growth regulators. Players compete against one another based on a variety of factors, such as product quality, costs, and services, as well as on innovation, sustainability, and corporate reputation. The main approaches used by businesses to increase their market share include joint ventures, M&As, distribution networks & geographic expansions, and the introduction of new products.

For instance, in December 2019, "CATàSYNTH Speciality Chemicals", a joint venture between Solvay and Anthea, a major producer of specialty chemicals in India, was founded. The two companies intended to use this to begin producing catechol derivatives. Additionally, it is committed to producing and supplying a wide range of goods, including helional, heliotropin (piperonal), and methylenedioxybenzene, which are widely utilized in the agrochemical, pharmaceutical, and flavors and perfumes industries. Some prominent players in the agrochemicals market include: Clariant AG, BASF SE, Huntsman International LLC, Bayer AG, The DOW Chemical Company, Solvay, Nufarm, Evonik Industries AG, Croda International Plc, Helena Agri-Enterprises, Ashland, Land O’ Lakes, FMC Corp., ADAMA Ltd., Stepan Company

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/agrochemicals-market

Comments

Post a Comment