Top 10 Leading Companies in Operating Room Integration Industry

The global operating room integration market size is anticipated to reach USD 3.5 billion by 2028, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 11.0% from 2021 to 2028. Increasing redevelopment projects and the adoption of advanced healthcare IT solutions in hospitals is a major factor boosting market growth. Operating Rooms (OR) are increasingly becoming complex and congested due to the requirement of devices during surgeries such as surgical lights, operating tables, and surgical displays. Integrated Operating Rooms (I-ORs) is becoming a solution for this complexity in ORs.

Though digitization was now high on the

agendas of most companies, the COVID-19 pandemic speeded up the paradigm shift

towards digitization in 2020. Besides, the trend towards digital ORs was also

quickened up by the pandemic. Thus, the COVID-19 crisis created new

opportunities to innovate and new ways to create value in the evolving

healthcare world. For instance, in March 2021, Olympus has introduced

EASYSUITE, a next-generation OR integration solution, in the EMEA area.

EASYSUITE features video management and routing, medical content management,

procedure recording, and virtual collaboration. As a result, with the

introduction of EASYSUITE, the company promoted digitalization in surgery and

boosted its position in the EMEA territory.

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/operating-room-integration-market

Operating Room Integration

Market Highlights

·

OR integrated services are expected to

witness the fastest growth rate in coming years owing to the growing demand

from ambulatory

surgical centers and hospitals

·

The documentation management systems

segment dominated the market in 2021 owing to the associated benefits such as

data management with minimal errors

·

Demand for fully integrated solutions to

automated surgical workflows is growing in accordance with the requirements to

access all the necessary information on a single platform. This helps in

expediting the surgical procedure and eliminates the need for various devices

arranged all over in the operating room

·

The orthopedic surgery segment is

anticipated to show a lucrative CAGR owing to its growing demand. There is an

increase in the number of cases of orthopedic conditions, including

osteoarthritis, osteoporosis, rheumatoid arthritis, and ligamentous knee

injuries

·

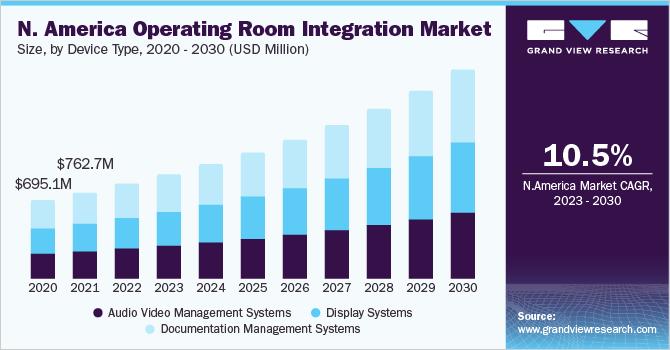

North America dominated the market as of

2021, which is attributable to supportive government initiatives promoting the

adoption of surgical automation, telemedicine, and other advanced technologies to

support the use of integrated solutions in operating rooms

·

Market players are involved in extensive

research for the development of cost-efficient and technologically advanced OR

integration solutions. Subsequently, the introduction of such solutions is

expected to provide the market with lucrative growth opportunities.

·

In April 2021, Barco proclaimed its

partnership with Sigma - Jones | AV LLP to deliver best-in-class digital

experiences in healthcare for its next-gen operating room video integration

solution Nexxis

Key Companies & Market Share Insights

The industry is fragmented with a large

number of players operating in this sector. The key players are focusing on

implementing new strategies such as regional expansion, mergers, and

acquisitions, improving their application portfolio through innovation,

partnerships, and distribution agreements to increase their revenue share and

mark their presence in the market. For instance, in April 2021, Barco launched

surgical teleconferencing, telementoring, and teleassistance solution called

NexxisLive as a secure cloud-based platform for ORs. While, in April 2021,

caresyntax’s digital surgery platform was selected as part of a pilot program

by the American Board of Surgery to enhance surgeon certifications with

video-based assessments.

Likewise in January 2020, Caresyntax

announced the installation of 16 digital ORs in Calvary Adelaide Hospital in

South Australia with its digital OR integration platform, PRIME365. These types

of initiatives are attributing to the increasing penetration of I-ORs in the

coming years. Furthermore, Innovations like these by the established market

players focused on introducing integrated OR platform globally is likely to propel

market growth. Some of the prominent players in the operating room integration

market include Stryker, Braiblab AG, Barco, Dragerwerk AG & Co. KGaA,

Steris, KARL STORZ SE & CO. KG, Getinge AB, Olympus, Care Syntax, Arthrex,

Inc.

Browse Full Report (Tables & Figures) @ https://www.grandviewresearch.com/industry-analysis/operating-room-integration-market

Comments

Post a Comment